Navigating the complexities of tax obligations can be daunting, especially when you find yourself under financial strain. Fortunately, there are numerous tax relief strategies available to individuals and businesses that can help alleviate the burden and bring clarity to your financial future. Whether you’re facing overwhelming tax debt, the threat of levies, or disputes with the IRS, understanding your options can provide significant relief. This blog explores these strategies in detail, highlighting how a tax relief attorney or debt relief law firm in Corpus Christi can guide you toward a resolution.

Understanding Tax Relief: A Path to Financial Stability

Tax relief refers to any program or initiative designed to reduce the amount of tax owed or provide a manageable way to pay off outstanding tax debts. These programs aim to offer financial reprieve and foster a pathway toward stability, enabling taxpayers to regain control over their financial health. The IRS offers several avenues for relief, tailored to meet various financial situations.

For individuals and businesses alike, understanding these strategies is crucial. Tax debt can feel like an insurmountable burden, but with the right approach, it is possible to find effective solutions. The key is not only to address immediate tax obligations but also to implement long-term strategies that prevent future issues. Seeking guidance from a tax relief attorney in Corpus Christi can make navigating these options less daunting and far more effective.

Key tax relief strategies include:

- Installment Agreements:Taxpayers who cannot pay their tax debts in full have the option to enter into an installment agreement with the IRS. This program allows them to break down the debt into smaller, more manageable monthly payments over time. However, negotiating favorable terms requires an in-depth understanding of IRS processes. A tax relief attorney can assist in crafting an agreement that aligns with your financial capabilities while ensuring compliance with IRS requirements.

- Offers in Compromise (OIC):The Offer in Compromise program allows eligible taxpayers to settle their tax debt for less than the full amount owed. While it sounds straightforward, the process involves a thorough evaluation of the taxpayer’s financial situation, including income, expenses, and asset equity. Successfully securing an OIC often requires meticulous preparation and presentation of a compelling case to the IRS. A debt relief law firm can provide expert assistance in navigating this intricate process and improving the likelihood of acceptance.

- Relief from Tax Levies:Tax levies are one of the most intimidating enforcement actions the IRS can take, as they allow the agency to seize bank accounts or other assets to satisfy unpaid tax debts. Seeking relief from tax levies is an urgent matter that demands immediate action. A tax relief attorney can intervene to negotiate a payment plan or even secure a levy release by demonstrating that the levy causes undue financial hardship. By acting swiftly and decisively, these professionals help taxpayers regain control over their assets and financial future.

- Innocent Spouse Relief:Joint tax filings can sometimes lead to one spouse being held accountable for errors or omissions made by the other. Innocent spouse relief provides an opportunity for the affected individual to avoid liability for certain tax debts incurred due to their partner’s actions. Proving eligibility for this program requires a detailed explanation of the circumstances, supported by evidence. An experienced tax attorney can guide applicants through the process, ensuring their rights are upheld.

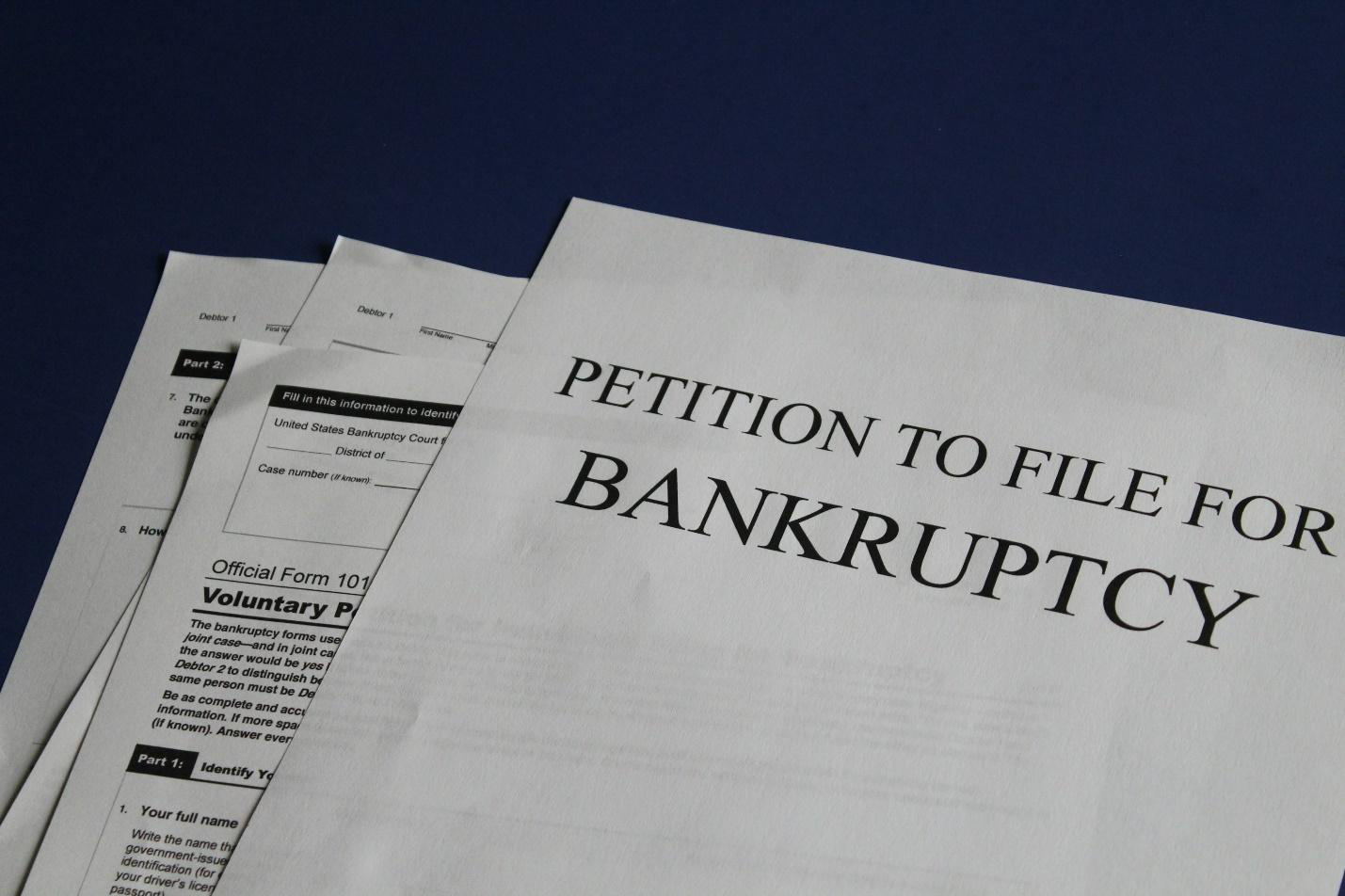

- Bankruptcy and Tax Debt:Bankruptcy is often perceived as a last resort, but it can be a powerful tool for resolving tax debts under specific conditions. Certain types of tax obligations may be discharged in bankruptcy, offering a fresh financial start. Filing for bankruptcy requires careful planning and thorough knowledge of tax laws, making the involvement of skilled bankruptcy lawyers These professionals analyze the taxpayer’s financial situation and determine whether Chapter 7 or Chapter 13 bankruptcy offers the most viable path forward.

By exploring these tax relief options, individuals and businesses can alleviate the stress of overwhelming tax obligations and work toward a more secure financial future. Tax relief is not a one-size-fits-all solution, which is why personalized advice from legal and financial experts plays a critical role in achieving successful outcomes.

Tax relief refers to any program or initiative designed to reduce the amount of tax owed or provide a manageable way to pay off outstanding tax debts. The IRS offers several avenues for relief, tailored to meet various financial situations. Key strategies include:

- Installment Agreements:If you’re unable to pay your tax debt in full, an installment agreement allows you to pay it off over time in manageable monthly payments. A tax relief attorney can help you negotiate terms that work best for your budget.

- Offers in Compromise (OIC):This option enables taxpayers to settle their debt for less than the full amount owed. Eligibility depends on factors like income, expenses, and asset equity. Navigating the OIC process can be complex, but a debt relief law firm in Corpus Christi can provide the expertise needed to present a compelling case to the IRS.

- Relief from Tax Levies:Tax levies or property seizures, can be devastating. Immediate action is crucial when dealing with a levy. Consulting with a tax relief attorney ensures you have a professional advocating for your rights and working to release the levy promptly.

- Innocent Spouse Relief:If you’re facing tax liability due to errors or omissions made by your spouse, you may qualify for innocent spouse relief. This program absolves you of responsibility for tax debts incurred by your partner.

- Bankruptcy and Tax Debt:In some cases, filing for bankruptcy can discharge certain tax debts. However, this process requires careful consideration and legal guidance. Experienced bankruptcy lawyers can help you understand whether this is a viable option for your situation.

How a Tax Relief Attorney Can Help

Dealing with tax-related challenges can be overwhelming, but a tax relief attorney offers specialized expertise to guide you through the complexities of the process. These professionals bring a wealth of knowledge and experience, enabling them to tackle even the most daunting tax issues effectively. Here’s how a tax relief attorney can make a significant difference:

- Expert Negotiation Skills:Tax relief attorneys are adept at negotiating directly with the IRS to secure favorable outcomes. This can include arranging installment agreements, reducing penalties, or even achieving an Offer in Compromise that allows you to settle your debt for less than what you owe.

- Comprehensive Legal Representation:Should your tax issues escalate to the level of litigation, a tax attorney provides crucial legal representation. They ensure that your rights are protected and present a compelling case to the court or IRS, leveraging their legal acumen to advocate on your behalf.

- Customized Solutions:Every tax situation is unique, and a one-size-fits-all approach rarely works. A tax relief attorney evaluates your specific financial situation, identifies the most suitable relief options, and tailors a strategy to resolve your tax issues

- Immediate Action Against Levies:If you’re facing a tax levy, a tax attorney can act quickly to stop the IRS from seizing your assets. They may negotiate a payment plan, file for a levy release, or demonstrate that the levy imposes an undue hardship on you, leading to its removal.

- Prevention of Future Issues:Beyond resolving your current tax challenges, an experienced attorney offers valuable advice on maintaining compliance with tax laws. They can guide you on record-keeping, timely filings, and other practices to prevent similar issues from arising in the future.

- Relief from Penalties and Interest:A tax attorney can often secure penalty abatement or reductions, significantly easing your financial burden. They can also address accrued interest on unpaid taxes by negotiating with the IRS to reduce or eliminate these additional costs.

- Strategic Use of Bankruptcy:In cases where bankruptcy may be the best path to relief, tax attorneys collaborate with bankruptcy lawyers to evaluate your options. They can determine whether filing for Chapter 7 or Chapter 13 bankruptcy is appropriate for discharging or restructuring tax debt, ensuring that you make an informed decision.

By working with a skilled tax relief attorney, you gain an ally who understands the intricacies of tax law and is committed to achieving the best possible outcome for your situation. Their expertise not only resolves immediate tax concerns but also lays the groundwork for a stable and secure financial future.

When facing tax issues, the stakes can feel insurmountable. The IRS wields significant power to enforce collections, which can disrupt your financial stability and personal life. Here’s how a tax relief attorney can be an invaluable asset:

- Negotiation Expertise:Tax relief attorneys are skilled negotiators who can work directly with the IRS to secure favorable outcomes, such as reduced payments or penalty abatement.

- Legal Representation:If your case escalates to litigation, having legal representation ensures that your rights are protected.

- Personalized Strategies:Every tax situation is unique. Attorneys assess your financial standing and tailor solutions that align with your needs.

- Compliance Assistance:Beyond resolving immediate tax issues, an attorney can help you implement practices to remain compliant in the future, preventing further complications.

The Role of Debt Relief Law Firms

A debt relief law firm in Corpus Christi specializes in helping clients manage and resolve financial obligations, including tax debt. These firms provide comprehensive services that address the root causes of financial distress. Here’s why partnering with a debt relief law firm is beneficial:

- Holistic Approach:Firms often have a team of professionals, including bankruptcy lawyers and financial advisors, to address all aspects of your financial health.

- IRS Communication:They handle correspondence with the IRS, ensuring that deadlines are met and that you’re represented professionally.

- Relief from Tax Levies:Debt relief firms act swiftly to halt collection actions, providing immediate relief while working toward a long-term solution.

Relief from Tax Levies: Taking Back Control

One of the most distressing aspects of tax debt is the threat of levies. The IRS can seize bank accounts or other assets to satisfy unpaid taxes. Seeking relief from tax levies requires prompt and decisive action. A tax relief attorney can:

- Negotiate a Payment Plan:Agreeing to an installment plan can halt levy actions.

- File for an Offer in Compromise:If you qualify, this can reduce the total amount owed and stop levies.

- Request a Levy Release:Attorneys can present evidence to the IRS showing that the levy causes undue hardship, potentially leading to its release.

Bankruptcy Lawyers: A Lifeline for Tax Debt Relief

While bankruptcy is often viewed as a last resort, it can be a powerful tool for discharging or restructuring tax debts. Experienced bankruptcy lawyers can evaluate your case to determine eligibility and guide you through the process. Key considerations include:

- Chapter 7 Bankruptcy:Certain older tax debts may be discharged under Chapter 7, provided specific conditions are met.

- Chapter 13 Bankruptcy:This option allows for the reorganization of debts, including tax obligations, into a repayment plan.

Why Choose the Law Office of Joel Gonzalez?

When navigating the complexities of tax relief, you need a trusted ally by your side. The Law Office of Joel Gonzalez specializes in providing comprehensive tax relief services, tailored to meet the unique needs of clients in Corpus Christi and beyond. With expertise in:

- Acquiring relief from tax levies

- Negotiating with the IRS

- Representation by experienced tax relief attorneys

- Collaboration with skilled bankruptcy lawyers

The Law Office of Joel Gonzalez stands out as a beacon of support and expertise. Their team works tirelessly to ensure that clients achieve financial peace of mind, offering personalized strategies and compassionate guidance.

Take the First Step Toward Financial Freedom

Don’t let tax debt control your life. Explore your options and take action today. Whether you’re seeking relief from tax levies, need assistance from a debt relief law firm in Corpus Christi, or require the expertise of seasoned bankruptcy lawyers, the Law Office of Joel Gonzalez is here to help. Contact them now to schedule a consultation and start your journey toward financial stability.