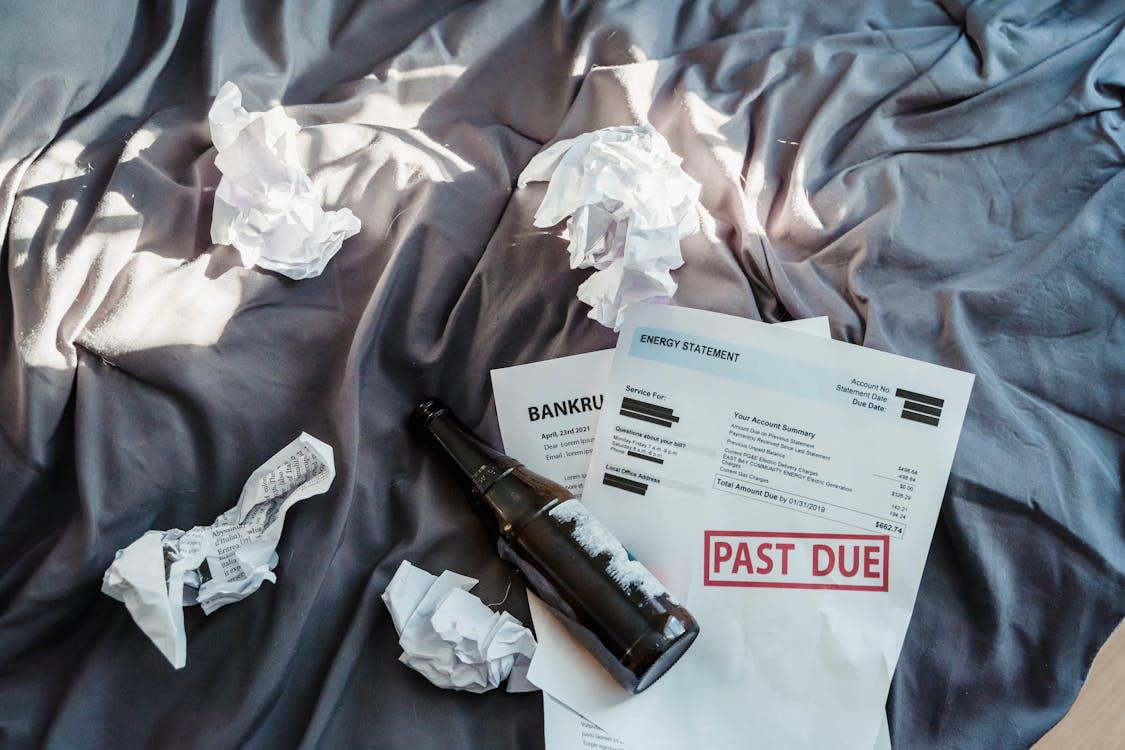

Chapter 7 bankruptcy is often referred to as a “fresh start” bankruptcy, designed to help individuals and businesses overwhelmed by debt achieve financial relief. This guide will take you through the essentials of Chapter 7 bankruptcy, including its purpose, eligibility requirements, step-by-step processes, and the long-term impact it can have on your financial life.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, also known as liquidation bankruptcy, allows individuals to discharge most unsecured debts. The process involves selling non-exempt assets to pay creditors, and offering a way to eliminate debts such as credit card balances, medical bills, and personal loans. If you’re drowning in financial obligations, filing for Chapter 7 bankruptcy can provide much-needed credit card debt relief and pave the way for a brighter financial future.

Eligibility Requirements

Before filing for Chapter 7 bankruptcy, it’s essential to ensure that you meet the eligibility criteria, as failure to do so can result in your petition being denied. Here’s a detailed breakdown of the primary requirements as described by a bankruptcy lawyer in Corpus Christi:

- Passing the Means Test:The means test is a critical step in determining eligibility. This test compares your monthly income to the median income level for households of a similar size in your state. If your income is below the state median, you automatically qualify. However, if it exceeds the median, further calculations will assess your disposable income after accounting for necessary expenses. If your disposable income is insufficient to repay debts, you may still qualify for Chapter 7 bankruptcy.

- Previous Bankruptcy Filings:Federal law places time restrictions on consecutive bankruptcy filings. If you have previously filed for Chapter 7 bankruptcy and received a discharge, you must wait at least eight years from the date of the prior filing to become eligible again. Similarly, if you filed under Chapter 13 and had debts discharged, the waiting period is six years.

- Credit Counseling:Completing an approved credit counseling course is mandatory before filing. This course, which must be taken within 180 days before filing, helps you explore potential alternatives to bankruptcy and ensures that you are fully informed about your financial options. Proof of completion must be submitted with your bankruptcy petition.

In addition to these core requirements, other factors, such as fraudulent activity or failure to provide complete financial information, can impact eligibility. Consulting a qualified Chapter 7 bankruptcy attorney is highly recommended to navigate these complexities. An attorney can assess your financial situation, guide you through the eligibility process, and provide the best course of action tailored to your circumstances.

Step-by-Step Process of Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy involves a series of critical steps designed to ensure an orderly resolution of debts while protecting your legal rights. Here’s a comprehensive guide to each stage of the process:

- Gather Financial Information:Begin by compiling a detailed inventory of your financial situation. This includes your income, monthly expenses, assets, liabilities, and any existing debt obligations. Proper documentation ensures accuracy and speeds up the process. It’s also helpful to review your recent credit report to ensure all debts are accounted for.

- Credit Counseling Course:Before filing, you are required to complete a credit counseling course from an approved agency. This step is vital, as it helps you understand all available debt relief options and provides a certification that must be submitted with your petition. These courses are typically straightforward and can often be completed online in a few hours.

- File a Petition:The next step is to formally file a bankruptcy petition with the court. Along with this petition, you must submit schedules that detail your assets, liabilities, income, expenses, and other financial information. This paperwork forms the foundation of your bankruptcy case, so accuracy is essential. Hiring a seasoned bankruptcy lawyer can make this step smoother by ensuring all documents are filed correctly.

- Automatic Stay:Once your petition is filed, an automatic stay immediately goes into effect. This legal protection halts all collection activities, including foreclosure proceedings, and creditor harassment. It provides much-needed debt collection relief by giving you a reprieve from financial pressure.

- Appointment of a Trustee:After filing, the court assigns a bankruptcy trustee to oversee your case. The trustee’s responsibilities include reviewing your financial documents, identifying non-exempt assets for liquidation, and ensuring creditors are treated fairly.

- Meeting of Creditors (341 Meeting):You are required to attend a meeting with the trustee and any creditors who wish to participate. During this meeting, you will answer questions under oath about your financial situation. While this might sound intimidating, it’s usually a straightforward process. Having your Chapter 7 bankruptcy attorney present can provide added confidence and support.

- Asset Liquidation:The trustee evaluates your non-exempt assets to determine which, if any, can be liquidated to pay creditors. Most individuals filing for Chapter 7 find that exemptions cover the majority of their assets, such as their primary residence, essential household items, and retirement accounts. Proper planning with your attorney ensures you maximize these exemptions.

- Debt Discharge:The final step in the process is the discharge of qualifying debts. This means you are no longer legally obligated to repay them. Debts that can typically be discharged include credit card balances, medical bills, and unsecured personal loans. This discharge marks the completion of your bankruptcy case and provides the financial relief needed for a fresh start.

Throughout this journey, partnering with a reliable Chapter 7 bankruptcy attorney ensures that every step is handled professionally, reducing stress and maximizing the benefits of filing for bankruptcy.

Debts That Can Be Discharged

One of the most significant advantages of Chapter 7 bankruptcy is the ability to eliminate various types of unsecured debts, providing substantial financial relief to filers. Below is a detailed breakdown of the debts that can generally be discharged through Chapter 7 bankruptcy:

- Credit Card Balances:The most common type of dischargeable debt, credit card balances, can be eliminated through Chapter 7 bankruptcy. This includes both regular purchases and fees associated with late payments or over-the-limit charges. By achieving credit card debt relief, filers can escape the cycle of mounting interest and regain financial stability.

- Medical Bills:High medical expenses can quickly become overwhelming, especially in cases of unexpected illnesses or accidents. Chapter 7 bankruptcy allows for the discharge of these debts, ensuring that individuals can focus on recovery without the added burden of financial stress.

- Personal Loans:Unsecured personal loans, including those from banks, online lenders, and even family or friends, can typically be discharged. This does not apply to secured loans, which are backed by collateral, such as a car or home.

- Utility Bills:Past-due amounts on utility bills, such as electricity, water, and gas, are eligible for discharge. This ensures that individuals can maintain access to essential services while addressing their broader financial obligations.

- Certain Business Debts:For self-employed individuals or small business owners, debts incurred during unsecured business operations may also be discharged.

- Judgment Debts:Monetary judgments from lawsuits (excluding fraud or intentional harm cases) can often be discharged, providing relief from court-ordered financial obligations.

While Chapter 7 bankruptcy offers significant debt relief, some debts are generally non-dischargeable, including:

- Student Loans:These are only discharged in cases of extreme hardship, which must be proven in court.

- Child Support and Alimony:These domestic obligations remain intact.

- Certain Tax Debts:Recent tax liabilities and those associated with fraud or evasion are not dischargeable.

- Debts Arising from Fraud:Debts incurred through fraudulent activities are excluded from discharge.

To fully understand which of your debts can be discharged, it’s essential to consult with a trusted debt relief firm in Corpus Christi. A knowledgeable Chapter 7 bankruptcy attorney can assess your financial situation and provide clear guidance on your eligibility for debt discharge.

Handling Assets in Chapter 7 Bankruptcy

Handling assets during Chapter 7 bankruptcy can feel overwhelming, but understanding how the process works can provide clarity and reassurance. In a Chapter 7 case, your non-exempt assets are subject to liquidation, meaning they may be sold by the trustee to repay creditors. However, federal and state laws provide exemptions that protect many essential assets, allowing you to retain items crucial for everyday living and long-term financial recovery.

Exempt vs. Non-Exempt Assets:

- Exempt Assets:These are items protected under bankruptcy law. Common exemptions include your primary residence (up to a certain value), a vehicle (up to a specified amount), household goods, clothing, and tools of trade necessary for your profession. Additionally, retirement accounts like 401(k)s and IRAs are typically safeguarded.

- Non-Exempt Assets:These include luxury items, second properties, high-value collectibles, and expensive electronics. The bankruptcy trustee may liquidate these assets to distribute the proceeds to your creditors.

- State and Federal Exemptions:The exemptions you can claim depend on your state of residence. Some states allow you to choose between state-specific exemptions and federal exemptions, while others mandate the use of state exemptions. Working with an experienced Chapter 7 bankruptcy attorney is vital to understanding and maximizing your exemptions.

State and Federal Exemptions

Exemption laws vary by state, and some states allow individuals to choose between federal and state exemptions. Federal exemptions offer a standard set of protections, while state exemptions can be more generous for specific items like homesteads or vehicles. Consulting a Chapter 7 bankruptcy attorney ensures that you maximize the exemptions available in your jurisdiction.

The Trustee’s Role in Asset Management

After filing for Chapter 7 bankruptcy, the court assigns a trustee to oversee the case. The trustee is responsible for:

- Reviewing your financial documents and identifying non-exempt assets.

- Selling non-exempt items and distributing proceeds to creditors.

- Ensuring compliance with bankruptcy laws to protect your rights and ensure fair treatment for creditors.

Liquidation Process

If non-exempt assets are identified, the trustee arranges their sale. This process is designed to be as efficient and fair as possible. The proceeds from liquidated assets are distributed among creditors according to a priority order, ensuring that secured debts are addressed first.

Working with a knowledgeable Chapter 7 bankruptcy attorney ensures that you maximize exemptions and protect critical assets.

Long-Term Effects on Credit

Filing for Chapter 7 bankruptcy will impact your credit score, with the bankruptcy remaining on your credit report for up to 10 years. However, many individuals find that their credit begins to improve soon after filing, as they can focus on rebuilding financial stability without the burden of overwhelming debt.

Access to Credit

Bankruptcy can make it challenging to obtain new credit in the short term, as lenders view it as a sign of financial instability. However:

- You may still qualify for credit cards or loans, but these often come with higher interest rates or limited borrowing amounts.

- Secured credit cards, which require a deposit, are an option for rebuilding credit responsibly.

Loan Approval Challenges

Post-bankruptcy, lenders may impose stricter criteria for approving loans, particularly for large purchases like homes or cars. However, as time passes and you demonstrate responsible financial behavior, your ability to secure loans with favorable terms improves.

Building Credit After Bankruptcy

The long-term effects of bankruptcy on credit can be mitigated through proactive steps to rebuild your financial reputation:

- Budgeting and Financial Discipline:Establish a realistic budget to ensure timely payment of all future obligations.

- Timely Payments:Consistently paying bills on time is one of the most effective ways to improve your credit score.

- Secured Credit Options:Use secured credit cards or small loans to demonstrate responsible borrowing and repayment.

- Monitor Your Credit Report:Regularly check your credit report for errors and dispute inaccuracies that could harm your credit score.

Why Choose the Law Office of Joel Gonzalez?

Navigating Chapter 7 bankruptcy can be complex, but you don’t have to face it alone. The Law Office of Joel Gonzalez specializes in providing comprehensive legal support for individuals and businesses seeking financial relief. As a leading debt relief firm in Corpus Christi, the firm is committed to helping clients achieve freedom from overwhelming financial burdens.

Whether you need assistance with filing, asset protection, or post-bankruptcy planning, their experienced team can guide you every step of the way. Take the first step toward financial freedom today. Contact the Law Office of Joel Gonzalez to schedule a consultation and explore how Chapter 7 bankruptcy can help you start fresh.