What would you do if medical debt became unmanageable? Medical expenses are a leading cause of financial hardship in the United States. An estimated 41% of adults have some form of medical or dental debt. Many individuals face staggering bills after unexpected emergencies, surgeries, or treatments for chronic conditions. Even with insurance, co-pays, deductibles, and out-of-pocket expenses can quickly pile up, creating a financial burden that feels impossible to escape.

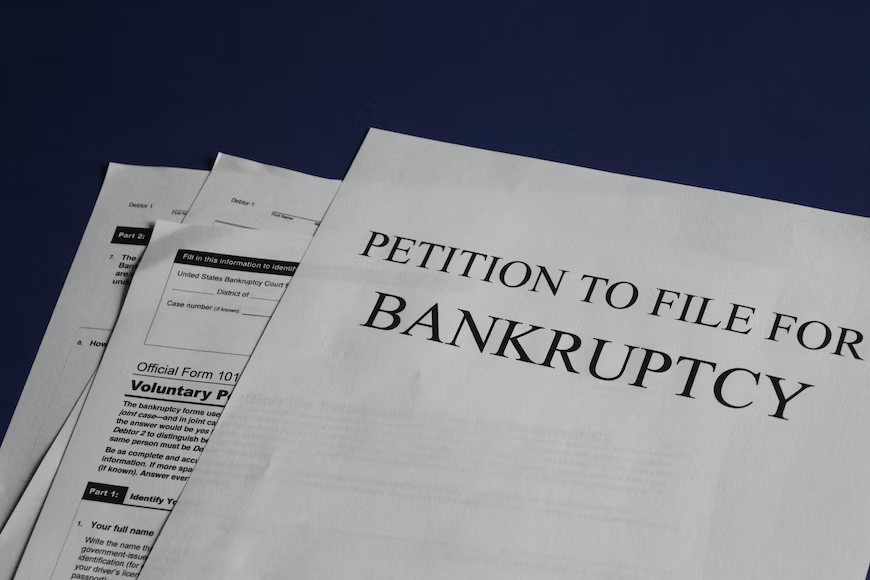

For individuals drowning in medical debt, filing for bankruptcy can be a powerful tool to regain control. Bankruptcy laws treat medical bills as unsecured, non-priority debt, making them eligible for discharge under specific bankruptcy chapters.

If you’re considering bankruptcy as a solution, the Law Office of Joel Gonzalez in Corpus Christi offers personalized legal guidance to help you navigate the process and find the best path forward.

This article will explain how Chapter 7 and Chapter 13 bankruptcy options can alleviate overwhelming medical debt, their differences, and the long-term impact of filing for bankruptcy relief in Texas. By the end, you will understand how the right approach can help you rebuild your financial future.

What Makes Medical Debt Eligible for Discharge Through Bankruptcy?

Medical debt is considered unsecured because it is not tied to collateral, such as a home or vehicle. Unlike secured debts, unsecured debts do not grant creditors the right to seize property if payments are missed.

When filing for bankruptcy, debts are classified as either priority or non-priority. Priority debts, such as taxes and child support, are given special consideration and are typically not dischargeable. Medical bills fall into the non-priority category, meaning they are eligible for discharge under both Chapter 7 and Chapter 13 bankruptcy.

This classification makes bankruptcy an effective way to address significant medical debt.

Understanding Chapter 7 Bankruptcy for Medical Debt Relief

1. What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is specifically designed to help individuals who lack the financial means to repay their debts. Unlike Chapter 13, which involves a repayment plan, Chapter 7 eliminates most unsecured debts outright. This includes medical bills, personal loans, and credit card balances.

Why is Chapter 7 called “liquidation bankruptcy”?

The term refers to the potential sale of non-exempt assets to repay creditors. However, in practice, most individuals filing for Chapter 7 in Texas are able to retain essential assets due to state exemptions. For someone buried under a mountain of medical bills, Chapter 7 offers immediate and complete relief from these obligations, paving the way for a fresh financial start.

2. How Does Chapter 7 Bankruptcy Work?

The process of filing for Chapter 7 bankruptcy is relatively straightforward but involves several important steps:

a. Eligibility Assessment Through the Means Test

- To qualify for Chapter 7, individuals must pass a “means test.” This test compares their income to the median income for a household of the same size in Texas. If their income falls below the median, they are eligible to file for Chapter 7.

- For those whose income exceeds the threshold, additional calculations may still prove eligibility by accounting for allowable expenses, such as housing, utilities, and medical costs.

b. Filing the Bankruptcy Petition

Once deemed eligible, the filer submits a bankruptcy petition to the court. This document includes:

- A complete list of debts, including medical bills.

- A record of assets, income, and expenses.

- Details of any recent financial transactions.

The filing triggers an automatic stay, immediately halting collection efforts, lawsuits, and harassing phone calls from creditors.

c. Role of the Bankruptcy Trustee

A court-appointed bankruptcy trustee reviews the filer’s case. Their responsibilities include:

- Evaluating the filer’s assets.

- Ensuring accurate reporting of debts and property.

- Overseeing the sale of any non-exempt assets, if applicable.

In Texas, generous exemptions often protect key assets, such as:

- Homestead exemption:Unlimited protection for a primary residence on land of 10 acres (urban) or 100 acres (rural).

- Personal property exemption:Protection for essentials like vehicles, furniture, and clothing.

This means most filers retain their homes, cars, and basic personal belongings during Chapter 7 proceedings.

d. Discharge of Medical Debt

Once the trustee completes their review, the court discharges eligible unsecured debts. For medical bills, this means the individual is no longer legally obligated to repay them. The result? Immediate financial relief and the ability to rebuild without the shadow of overwhelming medical debt.

Are medical bills keeping you awake? Here’s how bankruptcy can help. (Please link to CB1)

3. Key Advantages of Chapter 7 Bankruptcy for Medical Debt

a. Quick Process

The Chapter 7 process is one of the fastest ways to achieve debt relief. Unlike the years-long repayment plans required in Chapter 13, Chapter 7 typically takes only four to six months from filing to discharge. This makes it an ideal solution for individuals who need immediate relief from medical bills and other financial pressures.

b. Complete Discharge of Medical Debt

Medical expenses are considered unsecured, non-priority debts, which means they can be entirely discharged through Chapter 7. This allows individuals to move forward without being tied to repayment obligations for years to come.

Consider this scenario:

- A single surgery or prolonged hospital stay can generate tens of thousands of dollars in bills, even with insurance coverage.

- Filing for Chapter 7 eliminates these debts in full, ensuring they no longer impact the filer’s financial future.

c. No Repayment Plan Required

One of the primary benefits of Chapter 7 is that it does not require individuals to repay any portion of their unsecured debts. Unlike Chapter 13, which involves creating a repayment plan based on disposable income, Chapter 7 offers a clean break from medical bills without additional financial strain.

d. Generous Exemptions in Texas

Texas boasts some of the most debtor-friendly exemption laws in the country. This means that the likelihood of losing personal assets during Chapter 7 proceedings is minimal. Medical debt relief does not come at the cost of losing a home, vehicle, or other critical possessions.

e. Stress Relief Through the Automatic Stay

Upon filing, the automatic stay provides immediate relief by stopping all collection actions. For individuals facing harassment from medical providers, collection agencies, or lawsuits over unpaid bills, this legal protection brings significant peace of mind.

f. Financial Fresh Start

The most significant advantage of Chapter 7 is the opportunity for a true financial fresh start. By eliminating medical debt and other eligible obligations, filers can redirect their income toward essential living expenses, savings, and long-term financial goals.

Who Should Consider Chapter 7 Bankruptcy for Medical Debt?

Chapter 7 is particularly well-suited for individuals in the following situations:

- They have substantial medical debtbut limited income.

- They are unable to keep up with monthly payments for medical bills or other unsecured debts.

- They lack significant non-exempt assets.

- Their income is below the median household income for Texas or qualifies under the means test.

For individuals facing these challenges, consulting a bankruptcy attorney in Corpus Christi can clarify whether Chapter 7 is the best path forward.

Frequently Asked Questions About Chapter 7 and Medical Debt

1. Will all my medical bills be discharged in Chapter 7?

Yes, most medical bills are fully dischargeable under Chapter 7. However, debts incurred due to fraudulent activity or luxury spending may not be eligible.

2. Can I include other unsecured debts with my medical debt in Chapter 7?

Absolutely. Alongside medical bills, Chapter 7 can discharge credit card debt, personal loans, and other unsecured obligations.

3. What happens if I acquire new medical debt after filing for Chapter 7?

Only debts incurred before the bankruptcy filing date are eligible for discharge. New medical bills incurred post-filing would not be covered under the current bankruptcy case.

4. Will I lose my home or car if I file for Chapter 7?

In most cases, no. Texas exemptions are designed to protect essential assets, including your primary residence and a vehicle.

When Chapter 13 Bankruptcy May Be a Better Choice

1. What Is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy, known as “reorganization bankruptcy,” allows individuals to create a repayment plan to pay off a portion of their debts over three to five years. This option is ideal for those with regular income who want to keep non-exempt assets.

2. How Does Chapter 13 Bankruptcy Work?

When filing for Chapter 13, the filer submits a repayment plan to the court. This plan prioritizes secured and priority debts, with remaining disposable income allocated to non-priority debts like medical bills. After completing the repayment plan, any remaining unsecured debts, including medical expenses, are discharged.

3. Key Advantages of Chapter 13 Bankruptcy:

- Asset Protection: Filers can keep their property while catching up on overdue payments.

- Structured Repayment: Allows repayment of some medical debtover time, reducing immediate financial strain.

- Broader Eligibility: Suitable for individuals whose income exceeds the limits for Chapter 7.

Long-Term Implications of Filing for Bankruptcy Relief in Texas

1. Credit Impact

Bankruptcy filings will remain on your credit report for seven years (Chapter 13) or ten years (Chapter 7). While this can temporarily lower your credit score, it also provides an opportunity to rebuild financial health without the weight of overwhelming debt.

2. Debt-Free Restart

The discharge of medical debt through bankruptcy gives individuals a fresh financial start. This allows them to focus on essential expenses, savings, and future goals without the burden of unpaid bills.

3. Protections Against Future Collection Efforts

Once a bankruptcy case is filed, an automatic stay goes into effect, halting collection efforts from creditors. This includes phone calls, lawsuits, and other forms of harassment related to medical debt.

4. Access to Future Credit

While filing for bankruptcy may make obtaining credit challenging in the short term, many individuals find they can qualify for new credit within a year or two. Responsible credit management post-bankruptcy can significantly improve creditworthiness over time.

If you want to discover the true cost of medical debt, here is our guide to know when it’s time for considering legal solutions. (please link to CB2)

Steps to Take Before Filing for Bankruptcy

Assess Your Financial Situation

Review your income, expenses, and total debt to determine whether bankruptcy is the right solution.

Consider Alternatives

Explore other options, such as negotiating a repayment plan with healthcare providers or applying for financial assistance programs.

Consult a Bankruptcy Lawyer in Corpus Christi

Seek professional guidance from an experienced bankruptcy attorney in Corpus Christi to evaluate your case and choose the most suitable bankruptcy chapter.

Gather Necessary Documentation

Prepare a complete record of your debts, assets, income, and expenses to streamline the filing process.

Common Misconceptions About Bankruptcy and Medical Debt

1. Myth: Bankruptcy Means Losing Everything

Fact: Texas exemptions protect essential assets, ensuring individuals retain their homes, vehicles, and personal belongings in most cases.

2. Myth: Medical Debt Is Not Eligible for Discharge

Fact: Medical debt is unsecured and non-priority, making it fully dischargeable under Chapter 7 and partially dischargeable under Chapter 13.

3. Myth: Bankruptcy Permanently Damages Credit

Fact: While bankruptcy does impact credit in the short term, it also eliminates the financial stress of unpaid debts, allowing for rebuilding.

4. Myth: Filing for Bankruptcy Is an Admission of Failure

Fact: Bankruptcy laws exist to provide relief to those facing financial hardship due to circumstances beyond their control, such as medical emergencies.

Is Bankruptcy the Right Choice for Your Medical Debt?

Deciding to file for bankruptcy relief in Texas is a significant decision that requires careful consideration. Factors such as income, total debt, and personal financial goals play a critical role in determining whether Chapter 7 or Chapter 13 bankruptcy is the best option.

While bankruptcy is not a solution for all types of debt, it is a powerful tool for managing medical expenses. By providing relief from overwhelming bills, it enables individuals to regain control of their financial lives and focus on the future.

Take Control of Your Financial Future

Are mounting medical bills making it impossible to stay afloat? The Law Office of Joel Gonzalez can help. With years of experience as a bankruptcy lawyer in Corpus Christi, Joel Gonzalez specializes in guiding individuals through Chapter 7 and Chapter 13 bankruptcy cases. Whether you’re seeking immediate debt discharge or a structured repayment plan, Joel Gonzalez will work with you to find the best path forward.

Contact the Law Office of Joel Gonzalez at (361) 654-DEBT today to schedule a consultation. Start your journey toward financial freedom and put overwhelming medical debt behind you.