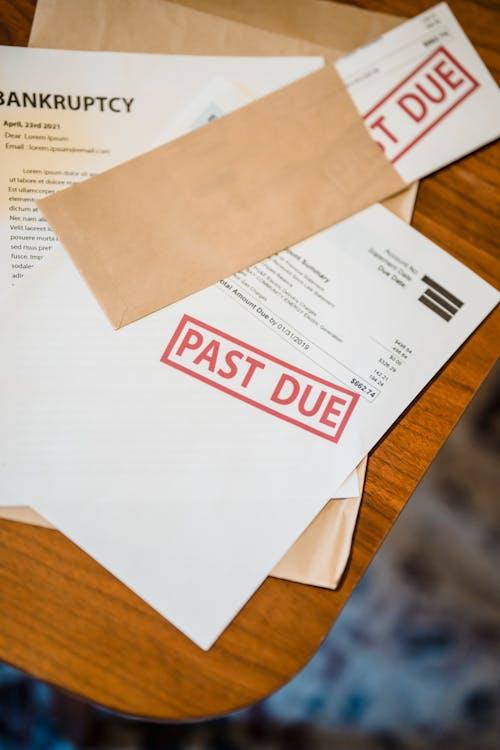

Filing for bankruptcy is a significant decision that can offer much-needed relief for individuals facing overwhelming debt. If you’re considering filing for bankruptcy in Texas, understanding the process can help ease some of the stress. This step-by-step guide will walk you through the process, from the initial decision to the court procedures, so you know what to expect at every stage.

1. Assess Your Financial Situation

The first step in filing bankruptcy in Texas is evaluating whether it’s the right option for you. Bankruptcy can be helpful if you are overwhelmed with medical bills, credit card debt, or facing a credit card lawsuit defense. However, it’s essential to understand the long-term consequences, such as the impact on your credit score.

2. Consult with a Bankruptcy Lawyer

It’s always advisable to consult with a bankruptcy lawyer in Corpus Christi or another experienced attorney in Texas before proceeding. A knowledgeable attorney will review your financial circumstances and help you determine whether Chapter 7 or Chapter 13 bankruptcy is the most suitable option. They will also help address medical bill collections for debt relief and provide insights into credit card lawsuit defense strategies.

3. Collect Financial Documents

Before filing, you’ll need to gather all relevant financial documents, including:

- Tax returns

- Pay stubs

- Bank statements

- Credit card statements

- Medical bills

These documents will be crucial for both your bankruptcy lawyer and the court to understand your financial situation.

4. Complete Credit Counseling

Texas law requires that individuals seeking to file for bankruptcy complete a credit counseling course. This course must be taken from an approved agency and is meant to help you evaluate whether bankruptcy is the right choice or if alternative debt relief options are available. Completing this course is mandatory before you can file your case.

5. File Your Bankruptcy Petition

With the help of your bankruptcy lawyer in Corpus Christi, you will file the official bankruptcy petition with the Texas bankruptcy court. The petition will include all of the financial information you’ve gathered, along with a statement of your income, expenses, and assets. Filing the petition initiates an “automatic stay,” which halts most debt collection actions.

6. Attend the 341 Meeting

After filing, you will need to attend the 341 Meeting, also known as the Meeting of Creditors. During this meeting, your creditors and the bankruptcy trustee will have the opportunity to ask questions about your financial situation. Your bankruptcy lawyer will help prepare you for this meeting, ensuring you understand what to expect and how to respond to any inquiries.

7. Receive a Discharge

Once the bankruptcy process is complete, the court will issue a discharge, which releases you from personal liability for most of your debts. This means that creditors can no longer attempt to collect on these discharged debts, allowing you a fresh financial start.

Why Choose the Law Office of Joe Gonzalez?

Navigating the process of filing bankruptcy in Texas can be overwhelming, but with the right guidance, you can find relief from mounting debts.  At the Law Office of Joe Gonzalez, I am dedicated to helping Texas residents overcome their financial challenges. As an experienced bankruptcy lawyer in Southern Texas, I specialize in providing tailored bankruptcy solutions, protecting my client’s rights, and ensuring a smooth bankruptcy process. If you’re considering filing for bankruptcy, contact the Law Office of Joe Gonzalez today to schedule a consultation.