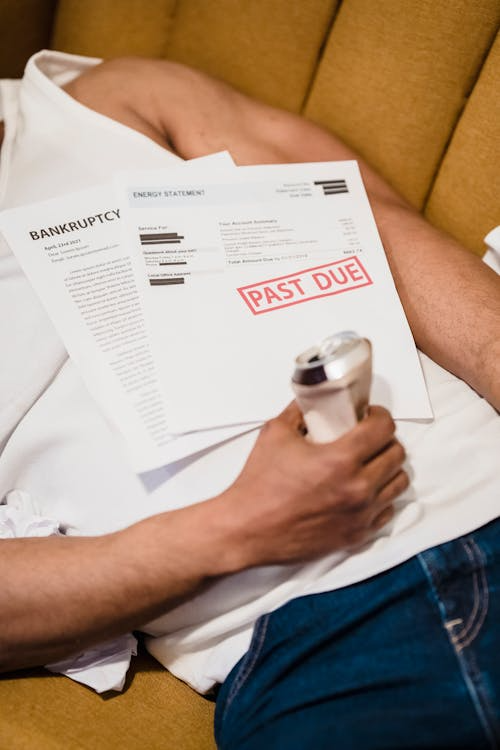

Many residents in Alice find themselves trapped in the cycle of payday loan debt, facing high interest rates, repeated borrowing, and relentless collection calls. This situation can create overwhelming stress and make it difficult to manage day-to-day expenses. For individuals struggling to break free, bankruptcy may provide a legal solution to regain financial control and protect essential assets.

Understanding Payday Loan Debt Challenges

Payday loans are often short-term, high-interest loans that can lead to mounting balances if not managed carefully. Borrowers may experience:

- Persistent calls and letters from collectors

- Increased financial stress due to compounding interest

- Difficulty keeping up with regular bills while repaying loans

In these cases, filing for bankruptcy can pause collection actions and give you time to evaluate long-term solutions.

How Bankruptcy Can Help

Filing for bankruptcy activates an automatic stay, which temporarily halts most debt collection activities. This can help residents:

- Stop collection calls and legal pressure

- Protect personal property from repossession

- Organize outstanding debts under a manageable plan

- Explore options with a debt relief attorneyfor overall financial recovery

It’s important to note that bankruptcy may be a better approach if other repayment strategies or settlements are not feasible.

Working with a Bankruptcy Attorney

An experienced bankruptcy lawyer can guide residents through the process and ensure their rights are fully protected. Key ways an attorney can help include:

- Explaining how the debt relief law applies to your situation

- Advising on debt settlementoptions and structured payment plans

- Guiding and addressing other financial obligations, including potentialrelief from tax levies

Having professional guidance can make the bankruptcy process more manageable and provide peace of mind as you take control of your finances.

Get Expert Guidance Today

For Alice residents struggling with payday loan debt, The Law Office of Joel Gonzalez offers individualized guidance in bankruptcy matters. Joel Gonzalez is a dedicated bankruptcy attorney. With a track record of high client satisfaction, we can help you stop collection calls, protect your assets, and regain financial stability.

Take the first step toward financial relief today. Contact us to speak with a bankruptcy attorney and start reclaiming control of your finances.