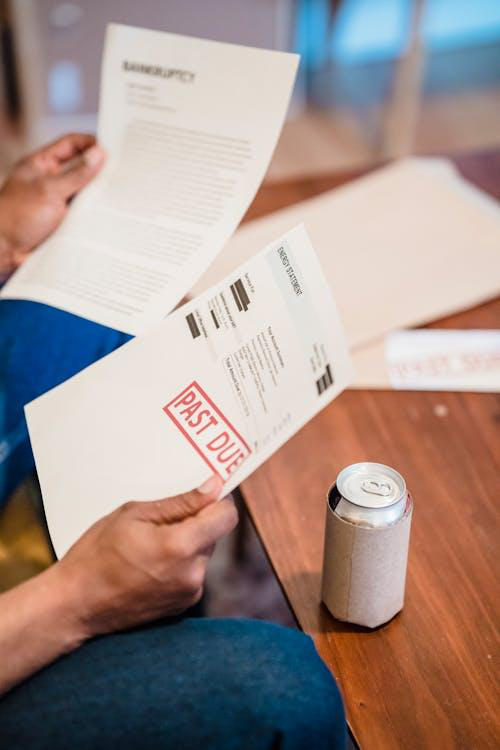

Financial challenges can become overwhelming, leaving individuals struggling to make ends meet. In such situations, Chapter 7 bankruptcy often provides a fresh start, wiping out unsecured debts and allowing you to regain financial stability. This blog explains the essentials of Chapter 7 bankruptcy, including eligibility criteria, the discharge process, and how it can help those burdened by debt.

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, allows individuals to eliminate unsecured debts, such as credit card bills, medical bills, and personal loans. Unlike other bankruptcy types, it does not require a repayment plan. Instead, a court-appointed trustee may liquidate non-exempt assets to pay creditors.

If you’re drowning in financial obligations, especially credit card debt, Chapter 7 bankruptcy could be the solution to achieve lasting credit card debt relief.

Eligibility for Chapter 7 Bankruptcy

To file for Chapter 7 bankruptcy, you must pass the means test, which evaluates your income and expenses. This test ensures that only individuals who genuinely need relief can qualify. A skilled Chapter 7 bankruptcy attorney can help determine your eligibility and guide you through the process.

Additionally, certain debts, such as child support, alimony, and most student loans, are not discharged through Chapter 7 bankruptcy. Consulting a debt collection relief attorney can help clarify which obligations can be wiped out.

The Chapter 7 Bankruptcy Process

The process of filing for Chapter 7 involves several steps:

- Filing a Petition:Work with a bankruptcy lawyer to prepare and file your bankruptcy petition with the court.

- Automatic Stay:Upon filing, an automatic stay goes into effect, stopping creditor harassment.

- Trustee Appointment:A trustee reviews your case and may sell non-exempt assets to repay creditors.

- Debt Discharge:After completing the process, most unsecured debts, such as credit card debt, are discharged, providing a clean financial slate.

How Chapter 7 Bankruptcy Provides Debt Relief

For individuals dealing with insurmountable credit card debt or constant harassment from debt collectors, Chapter 7 offers immediate relief. The automatic stay stops collection efforts, and the discharge of unsecured debts eliminates the financial burden. A trusted debt relief firm in Corpus Christi can help you navigate this journey to financial recovery.

Is Chapter 7 Bankruptcy Right for You?

Chapter 7 is ideal for individuals with little to no disposable income and significant unsecured debts. It may not be suitable for those with substantial assets or debts that are non-dischargeable. Consulting a Chapter 7 bankruptcy attorney can help you evaluate your financial situation and decide whether this form of bankruptcy aligns with your needs.

Why Choose the Law Office of Joel Gonzalez?

If you’re seeking expert guidance in Corpus Christi, the Law Office of Joel Gonzalez is here to help. As a leading debt relief firm in Corpus Christi, we specialize in providing personalized legal solutions for clients facing financial challenges. Whether you need assistance from a seasoned bankruptcy lawyer or a skilled debt collection relief attorney, our professionals will guide you every step of the way.

Don’t let financial struggles define your future. Contact the Law Office of Joel Gonzalez today to explore how Chapter 7 bankruptcy can offer a path to financial freedom.