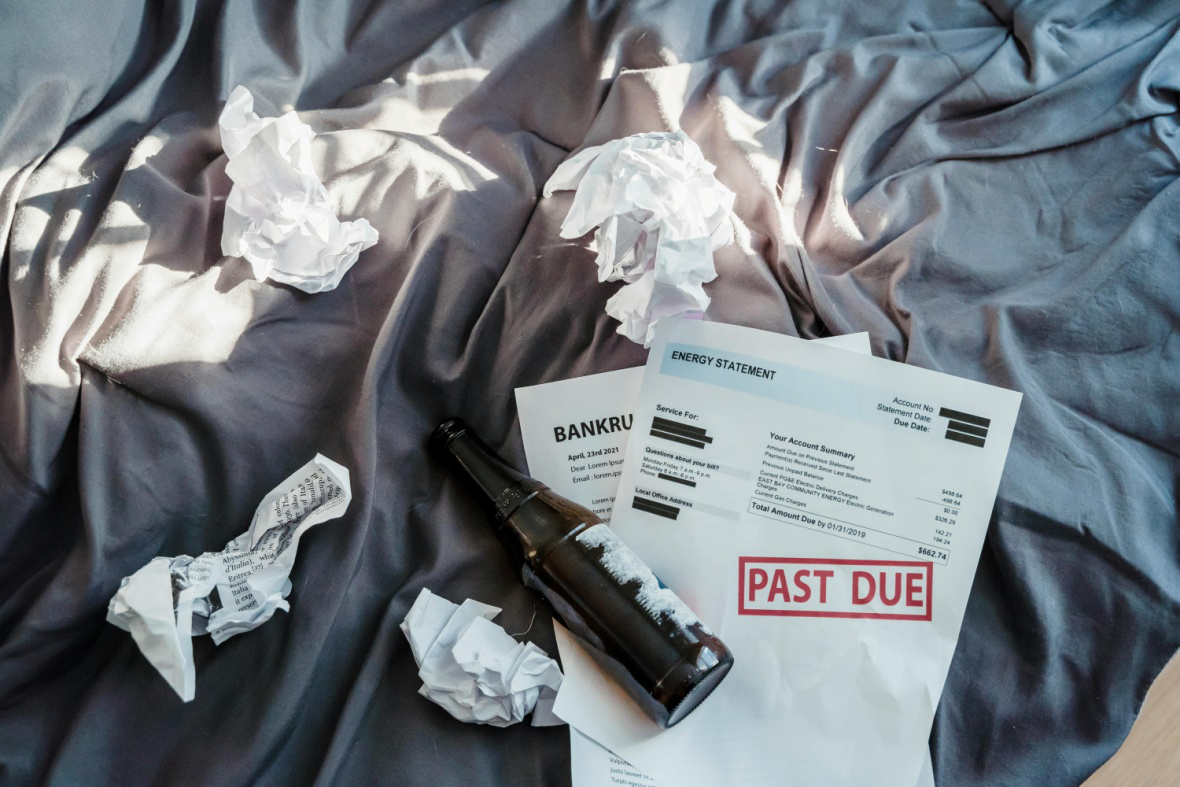

In today’s economy, many individuals find themselves grappling with overwhelming debt. According to a recent report, over 452,000 Americans filed for bankruptcy in the past year alone. This statistic highlights a pressing issue: the need for effective debt relief options. Bankruptcy can be a viable solution for those struggling to manage their financial burdens, but choosing the right type of bankruptcy is crucial.

Are you considering bankruptcy but unsure whether Chapter 7 or Chapter 13Â is the right path for you? Both options offer distinct benefits and challenges, and understanding their differences can help you make an informed decision.

As a dedicated bankruptcy attorney in Corpus Christi, Joel Gonzalez offers expert advice on both Chapter 7 and Chapter 13 bankruptcies.

This article will break down the eligibility criteria, debt discharge process, and potential consequences of Chapter 7 and Chapter 13 bankruptcies.

Understanding Bankruptcy: Chapter 7 vs. Chapter 13

Bankruptcy is a legal process designed to help individuals and businesses eliminate or repay their debts under the protection of the bankruptcy court. Chapter 7 and Chapter 13 are two of the most common types of personal bankruptcy, each with its own set of rules and outcomes.

Chapter 7 Bankruptcy: Liquidation

Chapter 7 bankruptcy, often referred to as “liquidation bankruptcy,” is designed to discharge most unsecured debts through the sale of non-exempt assets. This type of bankruptcy is typically suited for individuals who do not have significant assets and who meet specific income and eligibility requirements.

Eligibility Criteria for Chapter 7:

- Means Test:To qualify for Chapter 7, individuals must pass the means test, which compares their income to the median income for their state. If their income is below the median, they are eligible for Chapter 7.

- No Recent Bankruptcy Filings:Debtors cannot have had a Chapter 7 discharge in the past eight years or a Chapter 13 discharge in the past six years.

- Credit Counseling:Before filing, debtors must complete credit counseling from an approved agency.

Debt Discharge Process:

- Asset Liquidation:A bankruptcy trustee will review the debtor’s assets. Non-exempt assets are sold to repay creditors, while exempt assets are retained by the debtor.

- Discharge of Debts:Most unsecured debts, such as credit card balances and medical bills, are discharged, meaning the debtor is no longer legally obligated to repay them.

Potential Consequences of Chapter 7:

- Impact on Credit Score:Chapter 7 bankruptcy can significantly impact a debtor’s credit score, remaining on their credit report for up to ten years.

- Asset Loss:There is a risk of losing non-exempt assets, although many individuals do not lose any property if their assets are fully exempt.

- Not Suitable for All Debtors:Those with a high income or significant non-exempt assets may not qualify for Chapter 7.

Chapter 13 Bankruptcy: Reorganization

Chapter 13 bankruptcy, also known as “reorganization bankruptcy,” allows individuals to create a repayment plan to pay off their debts over three to five years. This option is often chosen by individuals who have a stable income but need assistance managing their debt.

Eligibility Criteria for Chapter 13:

- Regular Income:Debtors must have a regular income to fund the repayment plan.

- Debt Limits:There are limits on the amount of secured and unsecured debt a debtor can have. As of 2024, the limits are $465,275 for unsecured debt and $1,395,875 for secured debt.

- Credit Counseling:Similar to Chapter 7, debtors must complete credit counseling from an approved agency.

Debt Discharge Process:

- Repayment Plan:Debtors propose a repayment plan to the bankruptcy court, outlining how they will repay their debts over three to five years. The plan must be approved by the court and creditors.

- Debt Discharge:Upon successful completion of the repayment plan, remaining unsecured debts are discharged. However, some types of debt, such as certain taxes and child support, cannot be discharged.

Potential Consequences of Chapter 13:

- Longer Process:The repayment plan can last between three to five years, making Chapter 13 a longer process compared to Chapter 7.

- Impact on Credit Score:Chapter 13 also affects the credit score but remains on the credit report for up to seven years.

- Repayment Obligations:Debtors are required to make regular payments according to the court-approved plan, which can be a significant financial commitment.

Key Differences Between Chapter 7 and Chapter 13 Bankruptcy

Understanding the intricacies of Chapter 7 and Chapter 13 bankruptcies is essential for anyone considering these options. Each type has unique features and requirements that can significantly impact one’s financial situation.

Below is a detailed examination of the differences between these two bankruptcy options, covering duration and process, asset liquidation, income requirements, debt limits, and the types of debts discharged.

Duration and Process

Chapter 7 Bankruptcy:

- Timeline:Chapter 7 bankruptcy is often referred to as “liquidation bankruptcy” and is generally the quicker of the two options. The process typically takes about three to six months from the filing date to the discharge of debts. The efficiency of Chapter 7 is due to its streamlined nature, where non-exempt assets are liquidated to pay creditors, and most unsecured debts are discharged relatively quickly.

- Process Overview:After filing a Chapter 7 petition, a bankruptcy trustee is appointed to oversee the case. The trustee reviews the debtor’s financial situation, including assets and liabilities. A meeting of creditors is scheduled, during which the debtor answers questions about their financial status. If there are no objections and the means test is passed, the court issues a discharge order that eliminates most unsecured debts.

Chapter 13 Bankruptcy:

- Timeline:Chapter 13 bankruptcy, also known as “reorganization bankruptcy,” involves a more extended process. The debtor proposes a repayment plan that lasts between three to five years. The duration of the repayment plan depends on the debtor’s income and the amount of debt. Once you successfully complete the plan, remaining unsecured debts are discharged.

- Process Overview:The process begins with the debtor filing a petition and a proposed repayment plan with the bankruptcy court. The court then schedules a confirmation hearing to approve the plan. Throughout the repayment period, the debtor makes regular payments to a trustee, who distributes the funds to creditors. The completion of the plan results in the discharge of remaining eligible debts.

Asset Liquidation

Chapter 7 Bankruptcy:

- Non-Exempt Assets:In Chapter 7, non-exempt assets are subject to liquidation. This means that assets not protected by exemptions are sold by the bankruptcy trustee to pay creditors. Exemptions vary by state but generally cover essential items such as a primary residence, personal belongings, and certain amounts of retirement accounts.

- Impact on Assets:While the liquidation of assets is a key feature of Chapter 7, many debtors find that their assets fall within the exemption limits and are thus not sold. The goal of Chapter 7 is to provide a fresh start by discharging debts, but it can result in the loss of non-essential property.

Chapter 13 Bankruptcy:

- Asset Retention:One of the primary benefits of Chapter 13 is that it allows debtors to retain their assets. Unlike Chapter 7, which involves the sale of non-exempt assets, Chapter 13 focuses on repaying debts over time. Debtors are not required to liquidate their property as long as they adhere to the court-approved repayment plan.

- Repayment Plan:The repayment plan must include enough payments to cover the value of non-exempt assets that would have been liquidated under Chapter 7. This means that while debtors keep their assets, the repayment plan must ensure creditors receive at least as much as they would have under Chapter 7.

Income Requirements

Chapter 7 Bankruptcy:

- Means Test:Eligibility for Chapter 7 is determined through the means test, which compares the debtor’s income to the median income for their state. If the debtor’s income is below the median, they generally qualify for Chapter 7. If it exceeds the median, additional calculations are required to determine if the debtor can file for Chapter 7 or if they should consider Chapter 13.

- Income Constraints:The means test ensures that Chapter 7 is reserved for individuals with lower incomes who cannot afford to repay their debts. Those with higher incomes may not qualify for Chapter 7 and may need to file under Chapter 13.

Chapter 13 Bankruptcy:

- Stable Income:Chapter 13 requires a stable source of income to fund the repayment plan. The debtor must demonstrate the ability to make regular payments to the bankruptcy trustee according to the approved plan. The income level does not have a direct impact on eligibility as in Chapter 7, but it must be sufficient to cover the repayment obligations.

- Income Documentation:Debtors must provide detailed income documentation to the bankruptcy court, including pay stubs, tax returns, and other financial records. This information is used to assess the feasibility of the proposed repayment plan.

Debt Limits

Chapter 7 Bankruptcy:

- No Specific Limits:Chapter 7 does not impose specific limits on the amount of debt a debtor can have. However, debtors must meet the eligibility requirements, including passing the means test and not having recent bankruptcy filings. The focus is on whether the debtor’s income and assets justify filing for Chapter 7 rather than on the amount of debt alone.

Chapter 13 Bankruptcy:

- Debt Limits:Chapter 13 has specific debt limits for both secured and unsecured debts. As of 2024, the limits are $465,275 for unsecured debt and $1,395,875 for secured debt. Debtors with debts exceeding these limits may not be eligible for Chapter 13 and may need to consider other bankruptcy options or debt relief

Types of Debts Discharged

Chapter 7 Bankruptcy:

- Dischargeable Debts:Chapter 7 discharges most unsecured debts, including credit card balances, medical bills, and personal loans. However, certain types of debt are not dischargeable, such as student loans, child support, and most tax debts.

- Non-Dischargeable Debts:Debtors must continue to pay non-dischargeable debts even after completing Chapter 7 bankruptcy. These include certain types of government-related debts and obligations arising from fraud.

Chapter 13 Bankruptcy:

- Dischargeable Debts:Chapter 13 allows for the discharge of remaining unsecured debts upon successful completion of the repayment plan. This can include a significant portion of the unsecured debt, depending on the repayment plan and creditor agreements.

- Non-Dischargeable Debts:Similar to Chapter 7, some debts remain non-dischargeable under Chapter 13, such as certain taxes, child support, and student loans. Debtors must continue to address these obligations outside of the bankruptcy process.

Making the Right Choice: Chapter 7 or Chapter 13?

Choosing between Chapter 7 and Chapter 13 bankruptcy depends on individual financial situations and goals. Key factors to consider include:

- Current Income and Job Stability:Chapter 7 may be suitable for those with limited income, while Chapter 13 is designed for individuals with a stable income who can commit to a repayment plan.

- Asset Considerations:If retaining property is essential, Chapter 13 may be the better option as it avoids liquidation of assets.

- Debt Amount and Type:For high levels of debt or specific types of debt, Chapter 13 might offer more flexible repayment solutions.

Moving Forward with Bankruptcy

If you are struggling with debt and unsure which bankruptcy option is right for you, seeking professional guidance is crucial. An experienced bankruptcy attorney can help assess your financial situation, explain your options, and guide you through the bankruptcy process.

Ready to take the next step? If you need personalized advice and legal assistance, the Law Office of Joel Gonzalez is here to help. With a deep understanding of bankruptcy law, Joel Gonzalez can provide you with the guidance needed to make informed decisions and achieve financial relief.

Contact the Law Office of Joel Gonzalez today to schedule a consultation and explore how they can help you navigate your financial challenges and achieve a fresh start. Let Joel Gonzalez’s expertise in debt relief serve as your solution to financial freedom.