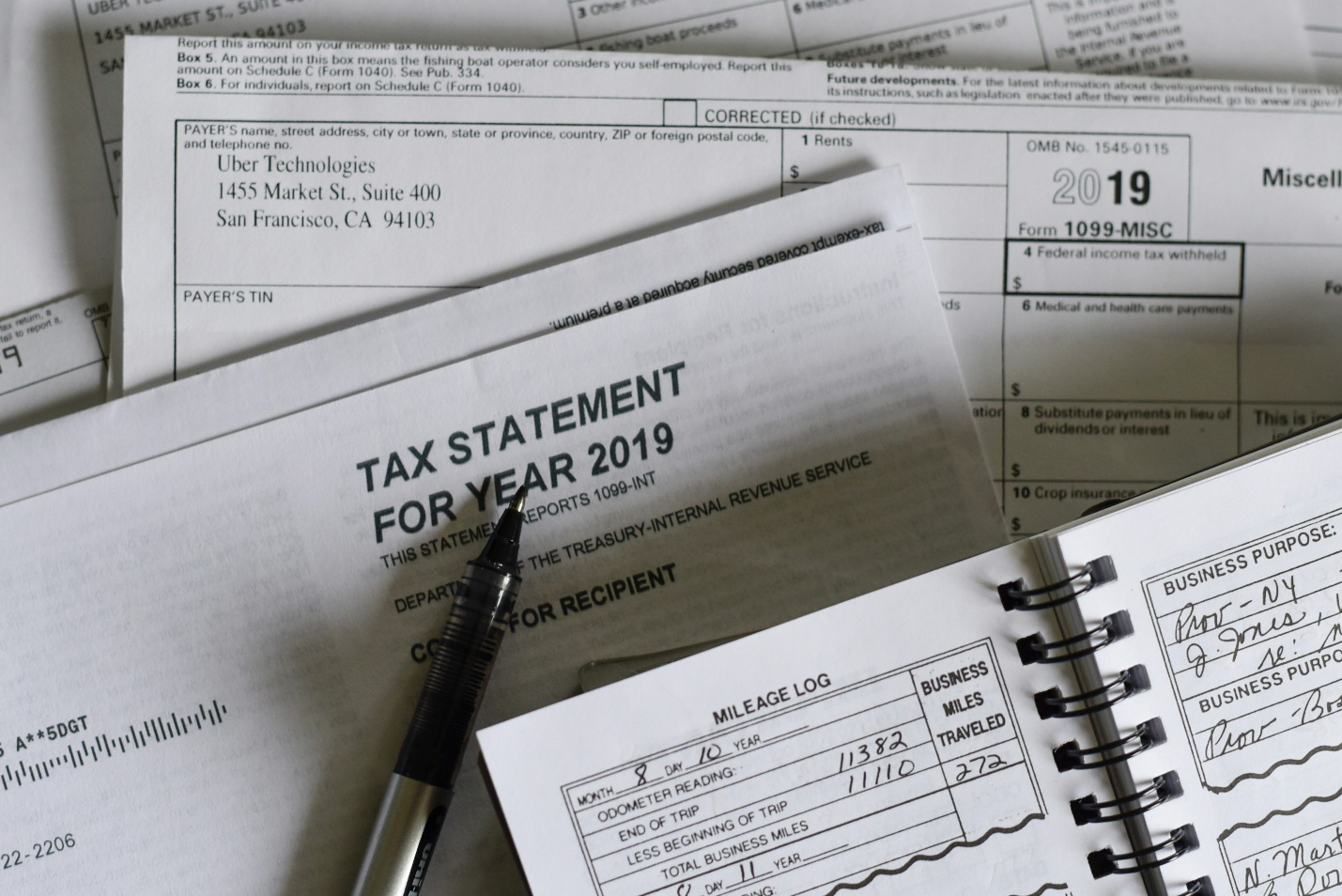

Dealing with tax issues can be daunting. From IRS audits to tax debt, individuals and businesses often find themselves facing challenging situations that require expert guidance.

This is where tax relief attorneys step in, playing a crucial role in protecting clients’ financial futures.

Let’s understand how these professionals advocate for their clients’ rights and interests for relief from tax levies.

Understanding Tax Relief Attorneys

Tax relief attorneys are legal professionals specializing in tax law. They possess in-depth knowledge of tax codes, regulations, and procedures, allowing them to provide comprehensive assistance to individuals and businesses dealing with tax-related issues.

These attorneys offer expertise in areas such as IRS audits, tax debt negotiation, penalty abatement, relief from tax levies, and tax litigation.

Expert Representation in IRS Audits

Facing an IRS audit can be intimidating, but tax relief attorneys provide expert representation to clients throughout the process.

They act as intermediaries between clients and the IRS, ensuring their rights are protected and treated fairly under the law. Tax relief attorneys help clients gather necessary documentation, prepare for interviews, and confidently navigate the audit process.

Strategic Guidance in Tax Debt Resolution

If left unresolved, tax debt can quickly escalate, leading to serious financial consequences. Tax relief attorneys work closely with clients to develop strategic solutions for resolving tax debt efficiently.

Whether through installment agreements, offers in compromise, or other debt reduction strategies, these professionals advocate for their clients’ best interests, helping them achieve financial stability and peace of mind.

Negotiating Penalty Abatement

Accruing penalties and interest on unpaid taxes can significantly increase the total amount owed to the IRS. Tax relief attorneys have the expertise to negotiate penalty abatement on behalf of their clients, potentially reducing or eliminating penalties associated with late payments or filing errors.

By advocating for penalty relief, these attorneys help alleviate the financial burden on their clients and facilitate the resolution of tax issues.

Legal Representation in Tax Litigation

In some cases, disputes with the IRS may escalate to tax litigation. Tax relief attorneys possess litigation experience and are prepared to represent clients in court proceedings, administrative hearings, and appeals.

Whether challenging IRS assessments or defending against tax-related claims, these attorneys advocate vigorously for their clients’ rights, striving for favorable outcomes and protecting their financial interests.

Tax relief attorneys play a vital role in safeguarding clients’ financial futures by advocating for their rights and interests in resolving tax issues.

Ready to protect your financial future? Contact the Law Office of Joel Gonzalez, a leading debt relief law firm in Texas, today for expert assistance with your tax issues. Whether you’re facing IRS audits, tax debt, penalty abatement, or seeking relief from tax levies, Joel Gonzalez is here to help.

Don’t let tax issues jeopardize your financial well-being – schedule your consultation now and take the first step towards securing your financial future.