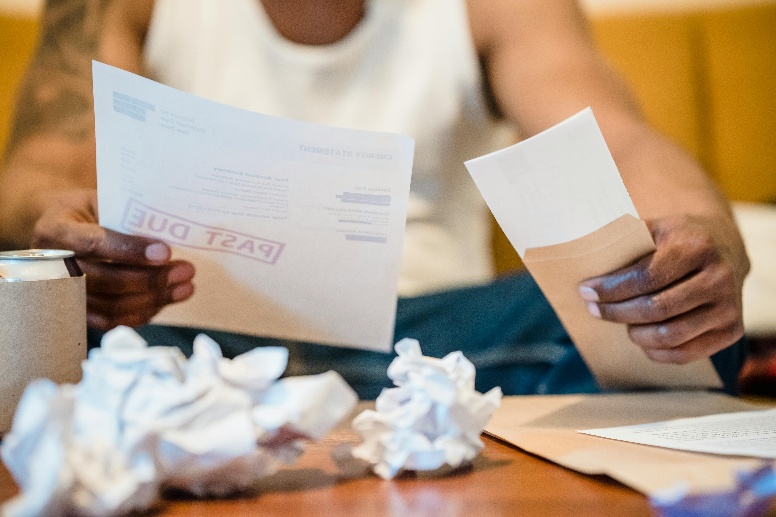

High-interest credit cards, payday loans, and aggressive collection calls can turn every day and night into a source of anxiety.

If you live in Robstown, Texas, and find yourself struggling to make even minimum payments, you’re not alone. The good news is that debt relief services can help you reduce stress, lower balances, and take back control of your finances.

From debt collection lawsuits to foreclosure lawsuits, legal experts in Robstown understand the local court systems, creditor tactics, and Texas-specific debt laws. Whether your financial struggle is tied to a single hardship or years of accumulating debt, there are solutions tailored to your needs.

Understanding Your Debt Relief Options In Robstown

Not all debts are the same, and neither are the solutions. Some people may benefit from negotiating with creditors through a debt settlement lawyer or debt relief law firm, as compared to doing it themselves.

Debt relief services in Robstown typically include:

- Debt settlement: negotiating lump-sum payments for less than you owe

- Bankruptcy filings: seeking legal discharge of eligible debts through Chapter 7 or Chapter 13 with the help of a bankruptcy lawyer

- Foreclosure defense: fighting a foreclosure lawsuit to help you keep your home

- Repossession defense: working with a repossession lawyerto stop or reverse the seizure of your vehicle or other property

- Relief from tax levies: using legal tools to prevent or remove IRS or state tax liens

How Legal Professionals Make A Difference

You might be thinking: “Can’t I just negotiate with creditors myself?” While it’s possible, the odds aren’t always in your favor.

Creditors have legal teams, and without a skilled bankruptcy lawyer on your side, you may not get the best possible outcome.

Robstown legal experts can:

- Ensure creditor compliance with Texas debt collection laws

- Represent you in court for a debt collection lawsuit or foreclosure lawsuit

- Review your financial situation and recommend the most effective path forward

Having professional guidance can mean the difference between sinking deeper into debt or finally getting ahead so you can start fresh.

When Bankruptcy May Be The Right Choice

Bankruptcy isn’t for everyone, but for many, it’s the most powerful debt relief tool available. In Texas, filing with a bankruptcy lawyer can immediately stop lawsuits, foreclosures, repossessions, and tax levies thanks to the “automatic stay” provision.

Two common types include:

- Chapter 7 bankruptcy: discharges most unsecured debts, like credit cards and medical bills, in exchange for liquidating non-exempt assets

- Chapter 13 bankruptcy: creates a repayment plan over 3–5 years, often allowing you to keep your property

An experienced bankruptcy attorney will explain your eligibility, exemptions, and the pros and cons of each option. They’ll also make sure you understand how to protect assets under Texas law.

Stopping Foreclosures, Repossessions, And Tax Levies

One of the most urgent reasons people seek debt relief services in Robstown is to stop losing their home, car, or wages. If you’re facing a foreclosure lawsuit, a legal team can negotiate with your lender or use bankruptcy filings to halt the process.

Similarly, if your vehicle is at risk, a repossession lawyer can work to prevent the lender from taking it, or even help you get it back, if it’s already been seized. For tax-related debt, attorneys can provide relief from tax levies to stop the IRS or state agencies from seizing your wages or bank accounts.

The Emotional Impact Of Debt Relief

Financial problems often affect your mental and physical health, relationships, and job performance.

By working with a debt relief law firm or a bankruptcy lawyer, you can gain the peace of mind that comes from knowing your case is in capable hands.

Debt relief services can:

- Reduce or eliminate creditor harassment

- Stop legal threats from escalating

- Give you a clear plan and timeline for recovery

Taking The First Step Toward Freedom

If debt is keeping you up at night, the most important thing is to take action now. Waiting too long can limit your options.

That’s where the Law Office of Joel Gonzalez can help. As a dedicated bankruptcy lawyer, Joel Gonzalez works one-on-one with clients to guide them through the process, from preparing documents to representing them in court. If you’re considering filing for bankruptcy, don’t wait until your hands are tied.

Contact us now to find out how we can help you file for bankruptcy relief in Texas before deadlines close doors you didn’t know were open.