Defending Against Debt Collection Lawsuits in Corpus Christi

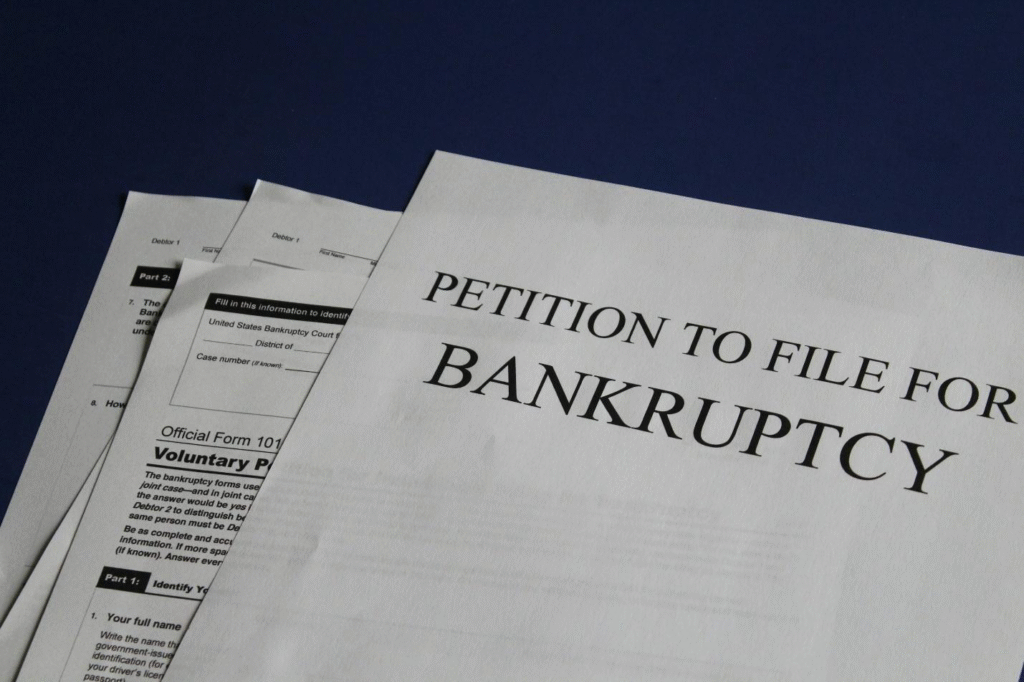

Have you recently received notice of a debt collection lawsuit and felt a wave of panic? You are not alone — according to the Consumer Financial Protection Bureau, millions of Americans are sued by creditors every year, and many lose by default simply because they fail to respond. Ignoring a lawsuit does not make it go away — […]

Defending Against Debt Collection Lawsuits in Corpus Christi Read More »