Debt Settlement Lawyers in Corpus Christi: How Negotiations Work

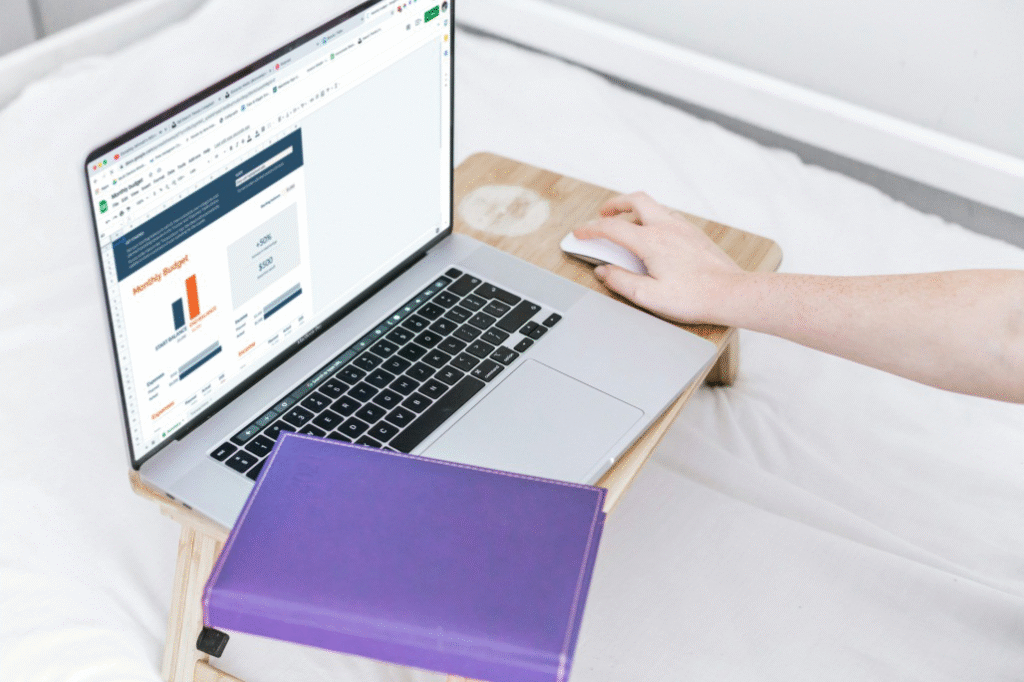

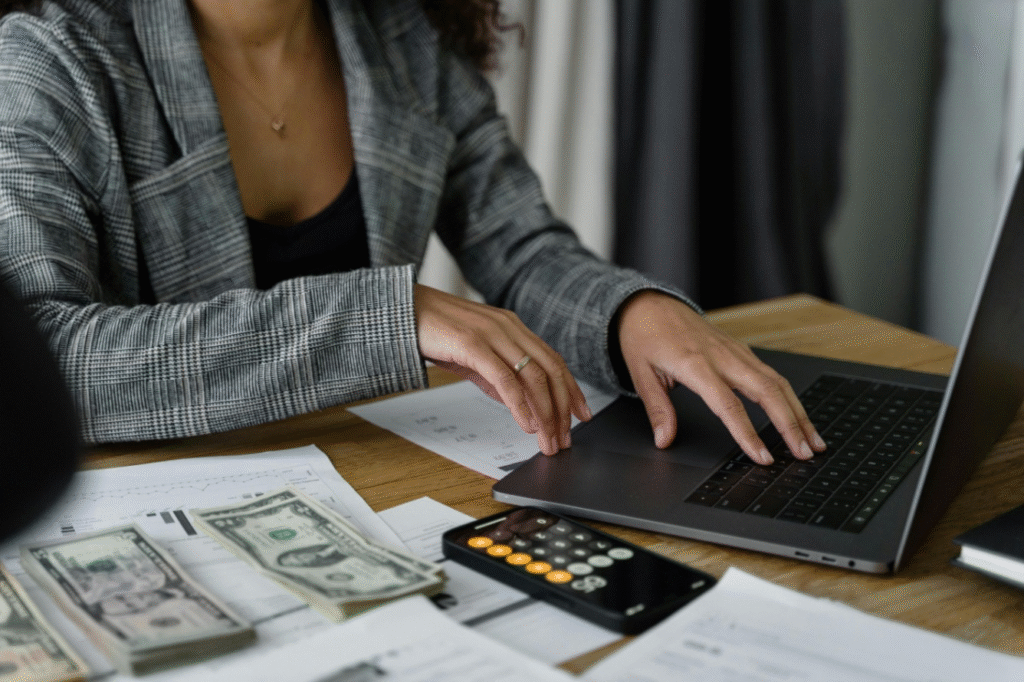

What happens when monthly payments pile up faster than income can cover them? For many Texans, growing credit card and loan balances turn into constant calls from collectors. As stress mounts, some turn to settlement companies that promise quick fixes but often leave clients in worse shape. Others seek help from a debt settlement lawyer — […]

Debt Settlement Lawyers in Corpus Christi: How Negotiations Work Read More »