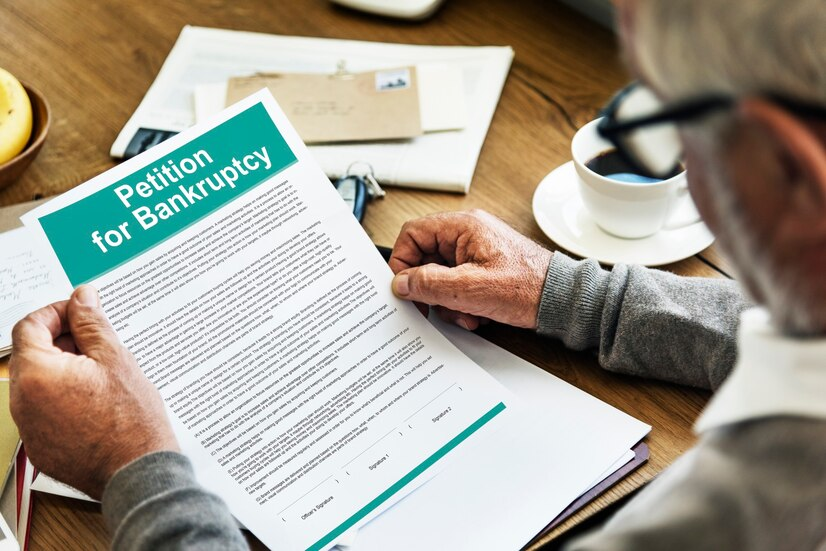

How Bankruptcy Can Help Manage Overwhelming Medical Debt

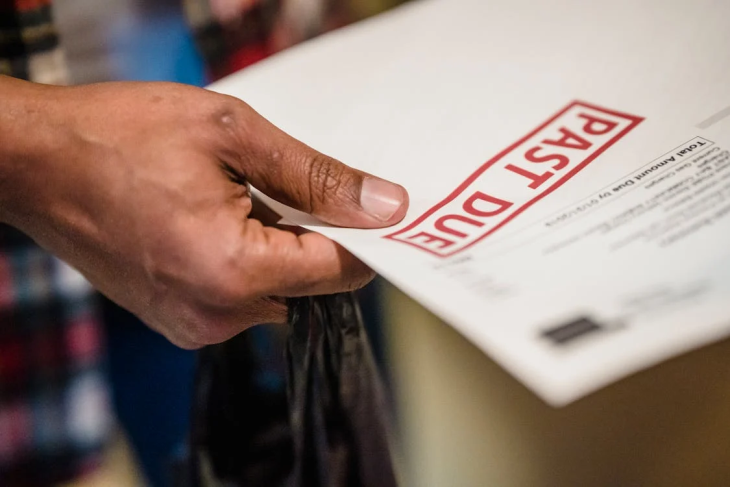

What would you do if medical debt became unmanageable? Medical expenses are a leading cause of financial hardship in the United States. An estimated 41% of adults have some form of medical or dental debt. Many individuals face staggering bills after unexpected emergencies, surgeries, or treatments for chronic conditions. Even with insurance, co-pays, deductibles, and out-of-pocket expenses […]

How Bankruptcy Can Help Manage Overwhelming Medical Debt Read More »