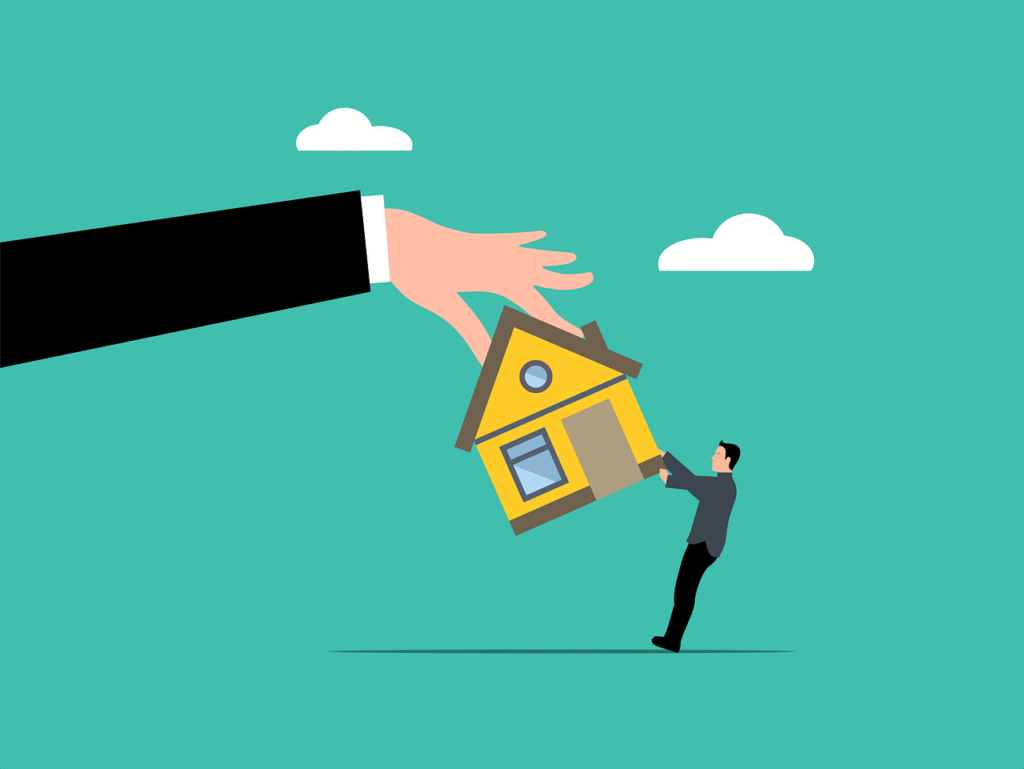

Repossession and Foreclosure in Texas: How Legal Help Can Put a Hold on Lenders’ Next Moves

What would you do if your car vanished overnight or a foreclosure notice landed in your mailbox? In Texas, more residents are facing that reality. In cities like Corpus Christi, many families are learning just how quickly lenders can act when a payment is missed.