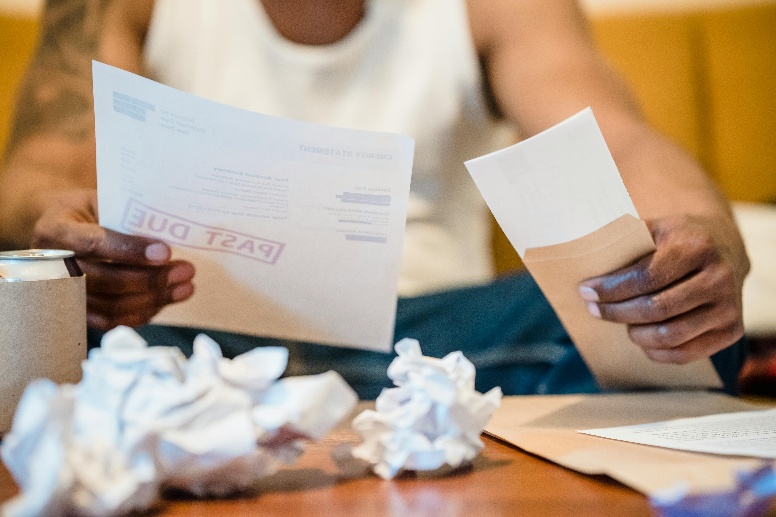

Are You Too Deep in Debt to Settle It on Your Own?

For many Texans, mounting debt feels like a never-ending cycle. According to the Federal Reserve, U.S. consumer debt has surpassed $17 trillion, with a significant portion coming from credit cards, medical bills, and personal loans. While some people attempt to handle creditors themselves, the reality is that negotiating reduced balances without the right strategy often […]

Are You Too Deep in Debt to Settle It on Your Own? Read More »